About FHA loans, Everything you need to know in 2021

123Movies [#PIN-1646]What is an FHA loan?

An FHA loan is a government-backed mortgage insured by the Federal Housing Administration. FHA home loans require lower minimum credit scores and down payments than many conventional loans, which makes them especially popular with first-time homebuyers. In fact, according to FHA’s 2020 Annual Report, more than 83 percent of all FHA loan originations were for borrowers purchasing their first homes.

While the government insures these loans, they are actually offered by mortgage lenders that have received the FHA’s stamp of approval.

How FHA loans work

FHA loans come in 15- and 30-year terms with fixed interest rates. The agency’s flexible underwriting standards are designed to help borrowers who do not have pristine credit or a high income and cash savings become homeowners.

But there’s a catch: Borrowers must pay FHA mortgage insurance. This coverage protects the lender from a loss if you default on the loan. Mortgage insurance is required on most loans when borrowers put down less than 20 percent.

All FHA loans require the borrower to pay two mortgage insurance premiums:

- Upfront mortgage insurance premium: 1.75 percent of the loan amount, paid when the borrower gets the loan. The premium can be rolled into the financed loan amount.

- Annual mortgage insurance premium: 0.45 percent to 1.05 percent, depending on the loan term (15 years vs. 30 years), the loan amount and the initial loan-to-value ratio, or LTV. This premium amount is divided by 12 and paid monthly.

So, if you borrow $150,000, your upfront mortgage insurance premium would be $2,625 and your annual premium would range from $675 ($56.25 per month) to $1,575 ($131.25 per month), depending on the term.

FHA mortgage insurance premiums will be canceled after 11 years for most borrowers if they financed 90 percent or less of the property’s value (in other words, made at least a 10 percent down payment) and stay current with their monthly mortgage payments. Loans with an LTV ratio greater than 90 percent will carry insurance until the mortgage is fully repaid.

FHA lenders are limited to charging no more than 3 percent to 5 percent of the loan amount in closing costs, which are the fees associated with originating the loan. The FHA allows a home seller, a builder and a lender to pay up to 6 percent of the borrower’s closing costs, such as fees for an appraisal, credit report or title search.

How to qualify for an FHA loan

To be eligible for an FHA loan, borrowers must meet the following lending guidelines:

- Have a FICO score of 500 to 579 with 10 percent down, or a FICO score of 580 or higher with 3.5 percent down

- Have verifiable employment history for the last two years

- Have verifiable income through pay stubs, federal tax returns and bank statements

Use the loan to finance a primary residence - Ensure the property is appraised by an FHA-approved appraiser and meets HUD guidelines

Have a front-end debt ratio (monthly mortgage payments) of no more than 31 percent of gross monthly income - Have a back-end debt ratio (mortgage plus all monthly debt payments) of no more than 43 percent of gross monthly income (lenders could allow a ratio up to 50 percent, in some cases)

- Wait one to two years before applying for the loan after bankruptcy, or three years after foreclosure (lenders might make exceptions on these waiting periods for borrowers with extenuating circumstances)

How to find an FHA lender and apply for an FHA loan

FHA borrowers get their home loans from FHA-approved lenders, which can have different rates, costs and underwriting standards even for the same loan. FHA loans are available through many sources, from the biggest banks and credit unions to community banks and independent mortgage lenders.

Applying for an FHA loan requires a few key steps:

- Know your budget. Before you submit an application for an FHA loan, you’ll want to know how much you can afford to spend on a home. Consider your current income, expenses and savings, and use Bankrate’s mortgage calculator to estimate your monthly payments based on different home prices and different sizes of down payment.

- Compile your documents. Applying to borrow a large chunk of money means handing over a complete look under the hood of your finances. Before you apply for an FHA loan, have all these documents ready to go: two years of tax returns; two recent pay stubs; your driver’s license; and full statements of your assets (checking account, savings account, 401(k) and any other places where you hold money).

- Compare your offers. Getting preapproved with multiple lenders is helpful so you can compare different rates and terms to make sure you’re getting the best deal.

FHA vs. conventional loans

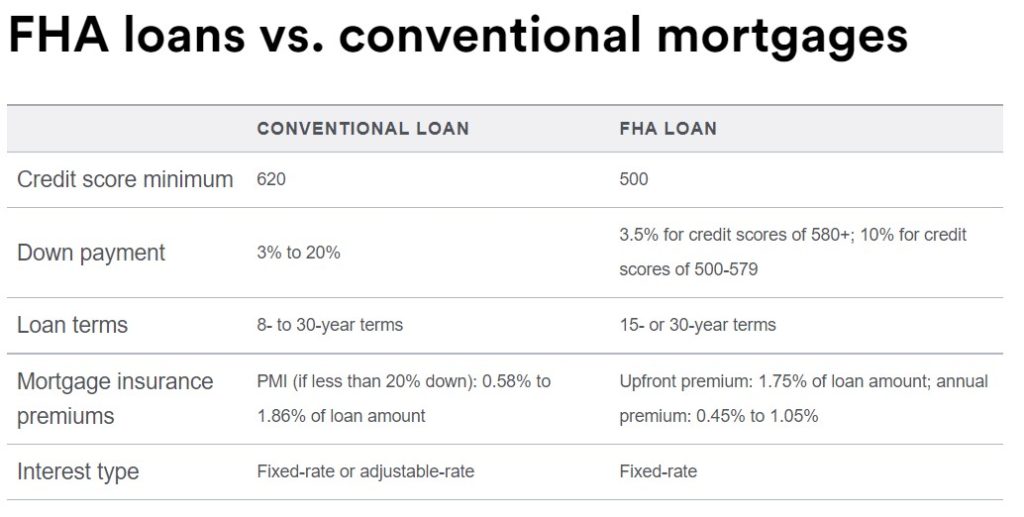

Unlike FHA loans, conventional loans are not insured by the government. Qualifying for a conventional mortgage requires a higher credit score, solid income and a down payment of at least 3 percent for certain loan programs. Here’s a side-by-side comparison of the two types of loans.

Pros and cons of FHA loans

Pros

- You can have a lower credit score: If you haven’t established much of a credit history or you’ve encountered some issues in the past with making on-time payments, a 620 credit score — the typical magic number for consideration of a conventional mortgage — might seem out of reach. If your credit score is 580, you’re in good standing with most FHA-approved lenders.

- You can make a lower down payment: FHA loans also give the option for a smaller down payment. With a credit score of at least 580, you can make a down payment of as little as 3.5 percent. If your credit score is between 500 and 579, you may still be able to qualify for an FHA-backed loan, but you will need to make a 10 percent down payment.

- You can stop renting earlier: Since FHA loans make buying a home easier, you can start building equity sooner. Instead of continuing to rent while trying to save more money or improve your credit score, FHA loans make the dream of being a homeowner possible sooner.

Cons

- You won’t be able to avoid mortgage insurance: Since your credit score is lower, you’re a bigger risk of default. To protect the lender, you have to pay mortgage insurance. You can roll the upfront insurance premium into your closing costs, but your annual premiums will be divided into 12 installments and show up on every mortgage bill. If you put down less than 10 percent, you have to pay those annual premiums for the entire life of the loan. There’s no escaping them. That’s a big difference from conventional loans: Once you build up 20 percent equity, you no longer have to pay for private mortgage insurance.

- You’ll have to meet property requirements: If you’re applying for an FHA loan, the property has to meet some eligibility requirements. The most important is the price: FHA-backed mortgages are not allowed to exceed certain amounts, which vary based on location. You have to live in the property, too. FHA loans for new purchases are not designed for second homes or investment properties.

- You could pay more: When you compare mortgage rates between FHA and conventional loans, you might notice the interest rates on FHA loans are lower. The APR, though, is the better comparison point because it represents the total cost of borrowing. On FHA loans, the APR can sometimes be higher than conventional loans.

FHA loan limits in 2021

Each year, the FHA updates its loan limits based on home price movement. For 2021, the floor limit for single-family FHA loans in most of the country is $356,362, up from $331,760 in 2020. For high-cost areas, the ceiling is $822,375, up from $765,600 a year ago. These limits are referred to as “ceilings” and “floors” that FHA will insure.

FHA is required by law to adjust its amounts based on the loan limits set by the Federal Housing Finance Agency, or FHFA, for conventional mortgages guaranteed or owned by Fannie Mae and Freddie Mac. Ceiling and floor limits vary according to the cost of living in a certain area, and can be different from one county to the next. Areas with a higher cost of living will have higher limits, and vice versa. Special exceptions are made for housing in Alaska, Hawaii, Guam and the Virgin Islands, where home construction is generally more expensive.

Home prices have reached record highs in 2021, so it’s safe to assume that the FHA loan limits for 2022 will increase in most areas of the country.

What will happen in "About FHA loans, Everything you need to know in 2021" For some more news when it comes to "About FHA loans, Everything you need to know in 2021" in video form, just check out the latest at the below of this article! After you watch it. remember to subscribe Channel ET20Today

Title: About FHA loans, Everything you need to know in 2021

Source: ()

As you turn on the #PIN-1646, a world of curiosity unfolds before your eyes. The screen flickers to life, illuminating the room with vibrant colors and captivating visuals. The curious tone in your mind wonders about the intriguing possibilities that lie ahead.

#PIN-1646 ChannelsWith a sense of anticipation, you flip through channels, each one offering something completely different. You stumble upon a documentary, showcasing the fascinating lives of penguins in the Antarctic. The camera captures their graceful movements as they waddle across the icy terrain. The narrator's voice is filled with excitement as they describe the penguins diving into the frigid waters, embarking on epic journeys in search of food.

#PIN-1646 NextNext, you stumble upon a cooking show, where a renowned chef shares their culinary expertise with viewers. The curious tone within you absorbs the tantalizing aromas and visually appealing presentations. The chef's descriptions of flavors, textures, and cooking techniques awaken your senses and ignite a desire to experiment in the kitchen.

Talk ShowAs the evening progresses, you tune into a talk show, filled with lively conversations and thought-provoking discussions. A panel of experts deliberates on pressing issues, sharing diverse perspectives that challenge your own thoughts and beliefs. The curious tone within you becomes engaged, questioning and analyzing the arguments presented, ready to expand your understanding of the world.

A Tale of Love and ResilienceFinally, you stumble upon a heartwarming movie, a tale of love and resilience. The curious tone within you becomes sentimental, following the emotional journey of the characters, their triumphs, and their hardships. You feel a sense of connection as their stories unfold on the screen, reminding you of the complexities and beauty of human experience.

TelevisionAs you reach for the remote to switch off the television, the curious tone within you satisfies its appetite for knowledge and entertainment. The TV screen fades to darkness, but the memories and insights gained remain, fueling your desire to explore further and discover even more wonders that await in the vast landscape of television.